The Burden of Student Loan Debt

February 18, 2021

https://sway.office.com/0rAloi49WQL56KUF

The average student loan debt in the United States is roughly $33,000 per person. President Joseph R. Biden Jr. has proposed to take off roughly a third of that debt for each individual.

In wake of the COVID-19 pandemic, Biden has proposed canceling $10,000 of federal student loan debt per person. He reasons that removing part of the existing $1.7 trillion in student loan debt is essential for his overall economic plan.

Biden’s original plan was to include student loan forgiveness in his COVID-19 relief package. However, most sources state that to achieve bipartisan support for student loan relief it needs to become legislation rather than an executive order. According to a January 21 article in U.S. News and World Report, Biden has searched for ways to extend the pandemic student loan deferment. This means people with student loans from the federal government are not required to make payments on these loans. These loan borrowers will not be accumulating interest on these loans during this time. This is in an effort to ease the burden on Americans whose employment may have been affected by the pandemic.

However, the actual removal of the proposed $10,000 forgiveness per borrower, has been excluded in the most recent relief package proposal. According to a January 15 article in Nasdaq, “Biden has said repeatedly he favors $10,000 in federal student loan forgiveness, he offered no forgiveness plan, or any other college-related aid for that matter, when he announced a $1.9 trillion stimulus package.”

How does President Biden’s plan directly apply to Buena Vista University?

President Brian Lenzmeier is aware of just how important $10,000 could be for BVU students as well as the university.

“That $10,000 loan forgiveness would be great. It would really help everybody,” Lenzmeier said. He went on to explain that decreasing the loans that students have to take out would make private institutions like Buena Vista more affordable for all.

As with any congressional bill or law, some people harshly disagree. The same is true for the idea of student loan

forgiveness. One of the main concerns against student loan forgiveness is that the $10,000 given to students will ultimately harm our economy by increasing our national debt, as well as, hurting our job market.

BVU sophomore Makaylee Tenhoeve, a secondary education major, sees this side of the argument. “A lot of Americans have had to pay off school debt. Why change now? It is only going to increase our national debt anyways,” Tenhoeve said.

Tenhoeve shares similar beliefs to many others on this issue. One of these people sharing similar beliefs is one of Iowa’s newest legislators, Rep. Ashley Hinson (IA-01). Hinson has been open about opposing the proposed $10,000 of student loan forgiveness.

On February 4, Hinson put out a tweet with an attached video. The tweet read, “Iowans have worked hard & sacrificed to pay off their student loans. I will stand strong against the Biden Administration’s efforts to ‘cancel’ $10k of student loan debt.” Ending with a hashtag IA01.

On Congresswoman Ashley Hinson’s webpage, it says “With our debt at a record high, it is imperative Washington rein in spending and take steps to balance the federal budget. The debt incurred today is an added tax burden on Americans tomorrow.” Efforts to reach Hinson by phone for an interview were unsuccessful.

What Hinson is arguing is that, if President Biden goes through with his student loan relief plan that we will be setting our future Americans up for failure because of the now insurmountable amount of debt that would occur because of this relief plan.

Current BVU students’ ideals conflict with that idea.

BVU sophomore Javier Sarmiento said, “What’s more important? Feeding people in need or worrying about the deficit that we can worry about later?”

Sarmiento shares the same beliefs that many others do. By ultimately giving people $10,000 in student loan forgiveness, some argue it will ensure that people can pay their loans as well as give the less fortunate a better chance at becoming successful.

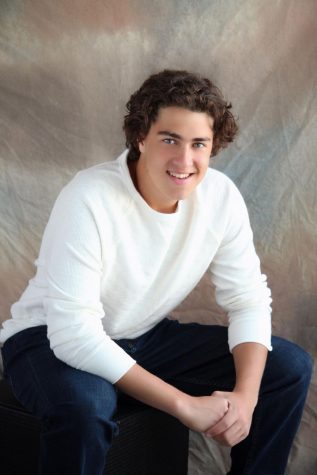

BVU junior Daniel Meissner knows just how beneficial this money could be for him and his future.

“I could put my saved money towards a house, groceries, or other essential needs for myself,” Meissner said.

Meissner would be putting all of that money that he would be using to pay his student loans right back into the economy by using it for after college living and other expenses.

Riley Flint, a BVU sophomore business education major, echoes Meissner’s thoughts. “Maybe someday I want to go to graduate school. I am much less likely to take on that responsibility if I have yet to even pay off my student loans from undergraduate school,” Flint stated.

By putting this money back into the economy Flint is not only being saved from extended years of paying on student loans, but he is also helping the economy in the process.

According to Education Data, it takes borrowers an average of roughly twenty years to pay off their student loans. Since COVID-19 has run rampant not only have people lost their lives but people have also lost their jobs, health care, insurance, as well as many other things. However, what people didn’t lose were their student loans.

Even though student loans are deferred right now that suspension is not indefinite. Post- pandemic, the loans are going to still be there.